This is similar to a runaway train - how do you stop something so huge and energy packed before it causes catastrophic damage some where down the line, especially when there isn't anyone on either side of the track willing to do what is necessary to stop the runaway because it might not work and then they will have to take the responsibility for a failed attempt.

That doing nothing will also cause huge damage is on consequence, but that's a lot safer politically then being blamed in the press for the damages when the damages can be blamed on some non-political person somewhere up the line.

The best thing to do is allow the train to pass their station and hope someone else will have the courage and intelligence to find away to stop it before it reach it's ultimate destination, then end of the line.

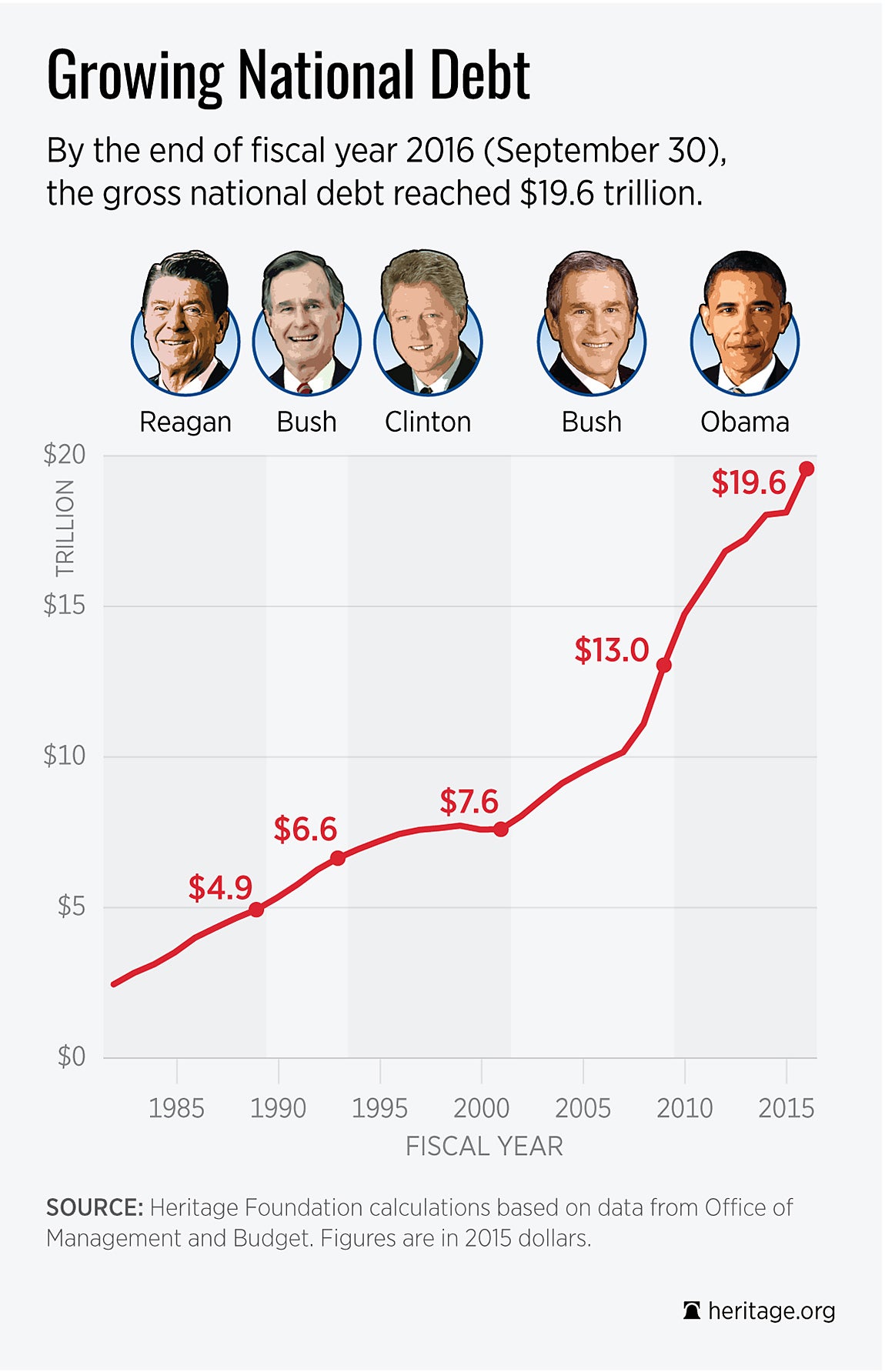

What You Need to Know About the National Debt, in 2 Charts

Lauren Bowman / Romina Boccia / @RominaBoccia /

The fact that the national debt jumped by $1.4 trillion in one short year should spur Congress to put an end to this excess. The debt hit a record-breaking high of $19.6 trillion at the close of the federal government’s 2016 fiscal year on Sept. 30. It had totaled $18.1 trillion at the end of the previous fiscal year.

The gross national debt includes intragovernmental debt, or debt the federal government owes to itself—for example, to the Social Security trust fund—in addition to debt held by the public.

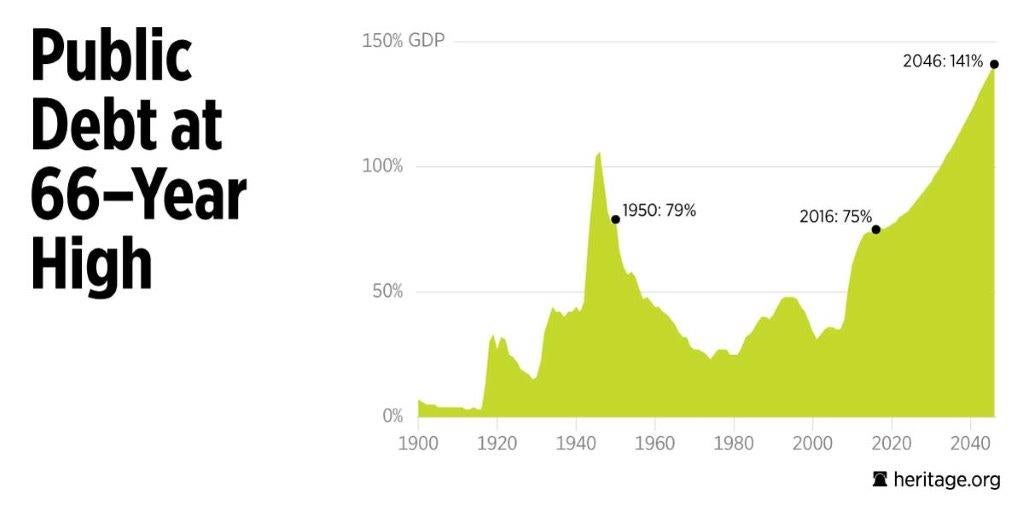

Federal debt held by the public now exceeds 75 percent of what the economy produced, as measured by gross domestic product. To put this into perspective, debt owned by the public surpassed 70 percent of GDP during only one other time in American history—from 1944 to 1950, due to the large expenditures for World War II.

The debt not only has skyrocketed but is projected to increase as budget deficits rise due to excessive spending. Social Security, Medicare, and Medicaid—three programs affected by the aging and retirement of the baby boomers—are especially key.

These three programs, along with interest on the debt and Obamacare, are projected to make up 83 percent of increased spending over the next decade. To seriously control spending and debt, Congress must alter the authorizing statutes of the programs.

Growing spending fuels the growth in debt. The Congressional Budget Office projects that the debt will rise to 86 percent of GDP by 2026, to 106 percent by 2035, and to 141 percent by 2046.

No comments:

Post a Comment