But in reality, those that ran on defunding or repealing ObamaCare to get elected or reelected, Republicans, have dropped the ball and now stand passively waiting for others, the progressive democrats, to tell them what will happen next.

Little wonder the frustration level is getting worse for those of us that believe we live in the greatest country in the world, we are find little hope for anything even close to fixing the catastrophic problems in our country brought on by Mr Obama and the progressive socialists democrats. If anything, the Republicans have made it worse by their will and complacency for politics as usual.

Interestingly, those that voted for this, twice, while waiting for something to eat in long lines, will have not clue why it has come to this.

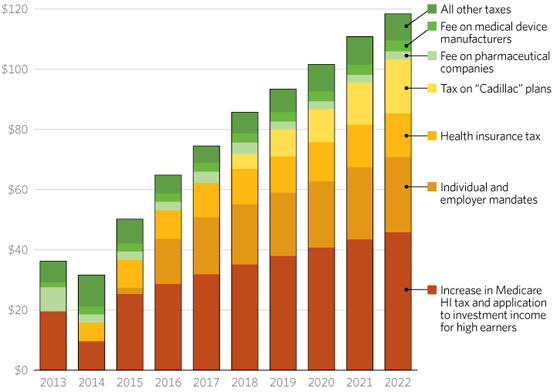

Obamacare’s $800 Billion Tax Hike Explained in One Chart

Alex Rendon

April 15 is right around the corner, and millions of Americans will find themselves paying more in taxes than ever thanks to Obamacare.

The law is more than a fundamental change to the country’s health care system. It also is a massive tax hike. As The Heritage Foundation’s Federal Budget in Pictures shows, according to the most recent scores, Obamacare will increase taxes by nearly $800 billion for the period of 2013-2022.

Obamacare contains 18 separate tax increases. A few of the biggest include a tax on “Cadillac” health insurance plans, which doesn’t take effect until 2018, long after President Obama and many in Congress who voted for the tax in 2010 have departed Washington.

Also, there is a tax on health insurance premiums and a higher rate on the Hospital Insurance payroll tax for single filers with incomes above $200,000 ($250,000 for married filers) that also applies to investment income.

Because of Obamacare, Americans are paying much higher taxes and those taxes are hurting the economy. Though some bipartisan efforts exist to repeal some of the new taxes that benefit special-interest groups, including the medical device tax, an incomplete approach won’t be sufficient to overcome the detrimental effects of this law.

Congress should repeal Obamacare and all of its tax increases.

Congress should repeal Obamacare and all of its tax increases. To learn more about federal spending, the national debt, and taxes, visit the 2015 Federal Budget in Pictures.

No comments:

Post a Comment