I don't know if these are actual cases of insanity but given our justice system, anything is possible. Remember the woman and the hot coffee that she spilled in her lap from McDonalds and got $millions? I think this was appealed but even so it says a lot about our justice system.

Here are a couple of the Stellas for this year: More to come.

SEVENTH PLACE * Kathleen Robertson of Austin, Texas was awarded

$80,000 by a jury of her peers after breaking her ankle tripping

over a toddler who was running inside a furniture store. The store

owners were understandably surprised by the verdict, considering the

running toddler was her own son.

A head scratcher? Start scratching!

SIXTH PLACE * Carl Truman, 19, of Los Angeles , California won

$74,000 plus medical expenses when his neighbor ran over his hand

with a Honda Accord. Truman apparently didn't notice there was

someone at the wheel of the car when he was trying to steal his

neighbor's hubcaps. Scratch some more...

Wednesday, September 30, 2015

The Obama Educational Legacy : Control of Outcomes

As usual, Mr Obama, it appears from his failed efforts to improve education, is not interested in education or anything else that is related to the betterment of sociality in general, what he is interested in is gaining control of the population by driving the states, federal subsides, and individuals into debt beyond their ability to repay, destructive college loans, and thereby eliminating their options for the freedom to chose their own actions to solve financial problems.

What ever happened with taking responsibility for your own actions, states solving their own problems with improving education by using there own available resources.

Mr Obama and the progressive socialist liberal democrats are all about dependency, control. A population that has few option will have no recourse other then doing the bidding of others. A good definitions of progressive socialism that is now in play.

The Real Obama Education Legacy

Source: Frederick M. Hess, "The Real Obama Education Legacy," National Affairs, September 2015.

September 29, 2015

What ever happened with taking responsibility for your own actions, states solving their own problems with improving education by using there own available resources.

Mr Obama and the progressive socialist liberal democrats are all about dependency, control. A population that has few option will have no recourse other then doing the bidding of others. A good definitions of progressive socialism that is now in play.

The Real Obama Education Legacy

Source: Frederick M. Hess, "The Real Obama Education Legacy," National Affairs, September 2015.

September 29, 2015

Back when he was first elected, President Obama promised to reform education declaring he was interested in "investment" not just spending. With an excellent choice according to both parties for Secretary of Education, Arne Duncan, a Democratic controlled House and the No Child Left Behind Act no longer popular, the opportunities for education reform seemed limitless.

- To reform public school education, in 2009, Secretary Duncan requested $4.35 billion dollars for Race to the Top, arguably the only significant education initiative of the administration.

- Race to the Top set aside $350 million for Common Core tests, which in 2009 had not yet been implemented.

- $4 billion went to helps states improve in order to meet 19 criteria established by the Department of Education. Three of those criteria could be met simply by promising to adopt the Common Core.

- By June 2011 most of the states who received funds from Race to the Top had either delayed or changed part of their plan.

- Two new programs, Early Head Start-Child Care Partnerships and Preschool Development Grants, include over 2,400 regulations which centers must comply with in order to meet "high standards of quality."

- Mrs. Obama led the drive for the $4.5 billion initiative Healthy, Hunger-Free Kids Act giving the USDA the right to regulate all school foods.

Federal Student Loan Repayment Options : Income Based

Again, given our current environment of 'no one has to take responsibility for anything', it's always someone else's responsibility to pay the bills and do the work so others don't have to. Little wonder unemployment is more then 93 million and the food stamp program is out of control.

Loan forgiveness programs? Something is very wrong here. College students are suppose to be smarter then average but still going to debt beyond their abilities for repayment?

I wonder how many college graduates are unemployed and on the food stamp program. At the same time how many have jobs and are capable of paying on their educational loans but many have decided having to pay off their loans will interfere with their social life and so go into default.

And as the progressive socialist have stated, don't worry about the little things like taking responsibility for your own actions, there will always be others that will, reliving you of the stressful parts of life that interfere with seeking the fun things. All that's required is you vote like you are told.

Federal Student Loans and Income-Based Repayment Plans

Source: "Federal Student Loans: Education Could Do More to Help Ensure Borrowers Are Aware of Repayment and Forgiveness Options," Government Accountability Office, September 17, 2015.

September 29, 2015

Loan forgiveness programs? Something is very wrong here. College students are suppose to be smarter then average but still going to debt beyond their abilities for repayment?

I wonder how many college graduates are unemployed and on the food stamp program. At the same time how many have jobs and are capable of paying on their educational loans but many have decided having to pay off their loans will interfere with their social life and so go into default.

And as the progressive socialist have stated, don't worry about the little things like taking responsibility for your own actions, there will always be others that will, reliving you of the stressful parts of life that interfere with seeking the fun things. All that's required is you vote like you are told.

Federal Student Loans and Income-Based Repayment Plans

Source: "Federal Student Loans: Education Could Do More to Help Ensure Borrowers Are Aware of Repayment and Forgiveness Options," Government Accountability Office, September 17, 2015.

September 29, 2015

In 2014, the total federal student loan debt in the United States was $1 trillion. Although the Department of Education offers income-based repayment plans and pay-as-you-earn options, only 13 percent of the total 51 percent of eligible borrowers participated in either program.

- 14 percent of borrowers defaulted on their loans within 3 years of entering repayment.

- Starting in 2017, the plan is to forgive all Direct Loan balances for any borrower who worked in public service for at least 10 years.

- Potentially 4 million borrowers could qualify for the Public Service Loan Forgiveness program.

College Bound Unaware of Actual Costs & Rewards

It is imperative that potential college students be educated about the actual costs and rewards for attending a university or college as this article has stated, but at the same time, test those students that want to attend to find out if they are capable of actually being able to do the work required. Many are not.

In reality, most students have no idea what they want when they enter higher education, and many are not mentally able to compete in a serious and stressful educational environment. It is estimated the more then 40% of student that leave high school and enter college do not belong there. Their talents are thought to be better served in local two year systems or technical school that provide skills for students that will serve the community and provide good financial reward. There are thousands of good paying jobs just waiting for skilled individuals.

Intended College Attendance

Source: Zachary Bleemer and Basit Zafar, "Intended College Attendance: Evidence from an Experiment on College Returns and Costs," Federal Reserve Bank of New York, September, 2015.

September 29, 2015

In reality, most students have no idea what they want when they enter higher education, and many are not mentally able to compete in a serious and stressful educational environment. It is estimated the more then 40% of student that leave high school and enter college do not belong there. Their talents are thought to be better served in local two year systems or technical school that provide skills for students that will serve the community and provide good financial reward. There are thousands of good paying jobs just waiting for skilled individuals.

Intended College Attendance

Source: Zachary Bleemer and Basit Zafar, "Intended College Attendance: Evidence from an Experiment on College Returns and Costs," Federal Reserve Bank of New York, September, 2015.

September 29, 2015

For the past 20 years enrollment rates at a two- or four-year colleges have remained relatively stable between 60 and 70 percent with the average college graduation rate at about 35 percent. The popular beliefs about the benefits and costs of a college education were astounding.

- On average, those surveyed believed that the current college graduate will earn $57,000 annually, an $18,000 underestimate.

- The average annual net cost of a four-year public college is believed to be $30,600 (it is actually $12,600) and the cost of a private college to be $43,400 (it is actually $23,300).

- The mean probability that a child will attend college is 80.2 percent, yet college-educated respondents predicted the probability at 87 percent, while non-college respondents said 76 percent.

- Even after being informed of actual costs of college, there was no statistically significant change on a child's college attendance expectations.

Tuesday, September 29, 2015

Putin Kicks Obama's Ass : The World is Laughing

And worse yet, most of the democrats still think he is the "One".

Mr Obama Creates Power Vacuum : The World Comes Appart

The problem is simple, the United States is responsible for leadership of the free world, but when that is no longer the case, the enemies of freedom take charge. It is obvious that since Mr Obama has been president our country and as our leader, the world has come apart at the seams.

In reality all of the problems that we face to day, a failing economy and the entire world in chase can be laid at Mr Obama's feet. He is the "one" and his ideology of progressive socialism that has brought this nightmare upon us all.

Of course, even in the face of all of this destruction of moral society, it was the main stream media continually extolling, misrepresenting what he actually said or lied to cover his tracks, his agenda and ideology that convinced the voting public to elect him twice.

So was it he press or the ignorance of the people that brought us this to this point in time where moralessness and shamelessness are the new norm?

The Purpose of Vacuums

Source: Allen West, "The Purpose of Vacuums," Townhall, September 23, 2015.

September 29, 2015

A few years ago, Israeli Prime Minister Benjamin Netanyahu warned about power vacuums in the Middle East if the United States withdrew its military footprint from the region. However, the Obama administration gave priority to campaign promises, rhetoric and rigid ideology and created a huge vacuum in the Middle East.

In the past three years, the result of this vacuum has become very evident, says Allen B. West, president and CEO of the National Center for Policy Analysis. An enemy that was defeated has now reconstituted, has secured swaths of territory and driven out historic communities. ISIS would not have been able to bring itself together if the U.S. had maintained the requested residual force in Iraq of 10,000-15,000 troops. Iran would not have been able to become more of an influencer in Iraq if that residual force in Iraq had been maintained.

Perhaps, Syria would not have descended into the deplorable situation which is having immense repercussions all the way to Europe. Furthermore, the Joint Comprehensive Plan of Action (JCPOA) does not clean up any mess; to the contrary, it exacerbates the problem.

When American forces were deployed in Iraq and Afghanistan, the U.S. had an ideal position to keep watch on Iran, the number one state sponsor of Islamic terrorism. But lately, America is about to become Iran's largest financial supporter as it releases hundreds of billions of dollars to the militant regime.

So, when a geopolitical vacuum is created, someone will try to fill that void and in this case it's Putin who has been sending Russian forces and military equipment to Syria. The lack of American action could result in Vladimir Putin being the key influencer in this region.

In reality all of the problems that we face to day, a failing economy and the entire world in chase can be laid at Mr Obama's feet. He is the "one" and his ideology of progressive socialism that has brought this nightmare upon us all.

Of course, even in the face of all of this destruction of moral society, it was the main stream media continually extolling, misrepresenting what he actually said or lied to cover his tracks, his agenda and ideology that convinced the voting public to elect him twice.

So was it he press or the ignorance of the people that brought us this to this point in time where moralessness and shamelessness are the new norm?

The Purpose of Vacuums

Source: Allen West, "The Purpose of Vacuums," Townhall, September 23, 2015.

September 29, 2015

A few years ago, Israeli Prime Minister Benjamin Netanyahu warned about power vacuums in the Middle East if the United States withdrew its military footprint from the region. However, the Obama administration gave priority to campaign promises, rhetoric and rigid ideology and created a huge vacuum in the Middle East.

In the past three years, the result of this vacuum has become very evident, says Allen B. West, president and CEO of the National Center for Policy Analysis. An enemy that was defeated has now reconstituted, has secured swaths of territory and driven out historic communities. ISIS would not have been able to bring itself together if the U.S. had maintained the requested residual force in Iraq of 10,000-15,000 troops. Iran would not have been able to become more of an influencer in Iraq if that residual force in Iraq had been maintained.

Perhaps, Syria would not have descended into the deplorable situation which is having immense repercussions all the way to Europe. Furthermore, the Joint Comprehensive Plan of Action (JCPOA) does not clean up any mess; to the contrary, it exacerbates the problem.

When American forces were deployed in Iraq and Afghanistan, the U.S. had an ideal position to keep watch on Iran, the number one state sponsor of Islamic terrorism. But lately, America is about to become Iran's largest financial supporter as it releases hundreds of billions of dollars to the militant regime.

So, when a geopolitical vacuum is created, someone will try to fill that void and in this case it's Putin who has been sending Russian forces and military equipment to Syria. The lack of American action could result in Vladimir Putin being the key influencer in this region.

Progressive Democrats Use North Korea As Model for CO2 Reduction

According the Mr Obama and the progressive socialist liberal democrats, global warming and or climate change is the most dangerous thing we face in today's society, in both domestic and foreign policy.

It appears that insanity has no limits. Little wonder, when people are confronted with the insane, they cannot comprehend the abstract notion of something our to nothing presented by the progressive socialists, and the reality of understanding their leaders are truly insane is just to much to cope with on a daily basis, so to ward off mental collapse they turn to their smart phones for comfort.

How to Lower American Living Standards to that of North Korea

Source: Robert Bryce, "How to Lower U.S. Living Standards," Wall Street Journal, September 21, 2015.

September 28, 2015

California governor Jerry Brown, along with other prominent democrats such as President Obama, Hillary Clinton and Bernie Sanders want to cut carbon-dioxide emissions by 80% by 2050 (80 by 50) to levels of that of developing countries such as North Korea.

Earlier this month the California Assembly rejected a bill that would have required the state to reduce emissions by 80%. In addition, all of the candidates seeking the Democratic nomination for president support this emissions reduction program. What would 80 by 50 mean for individuals? Residents of California are responsible for the emission of about 9.42 tons of carbon dioxide per capita per year, the program would cut those emissions to 1.88 tons by 2050. Achieving 80 by 50 on a national basis will be even more painful, as the national average is 16.15 tons per capita. Wind and solar energy cannot be the solution.

Their land-use requirements are enormous, they can't store large quantities of electricity and their transmission is intermittent. Nuclear energy is doing more to cut carbon-dioxide emissions than any other form of energy, but Democratic politicians and their supporters decry it. None of the plan's supporters has provided a cost estimate but it's likely that it would cost more than $5 trillion.

In short, the leading Democrat contenders for the White House, have endorsed an agenda that will have a massive cost. Yet not one of them has provided a credible plan for achieving such reductions without wrecking the economy. They do not even discuss a plan that is affordable and technically viable because that is a very unlikely scenario.

It appears that insanity has no limits. Little wonder, when people are confronted with the insane, they cannot comprehend the abstract notion of something our to nothing presented by the progressive socialists, and the reality of understanding their leaders are truly insane is just to much to cope with on a daily basis, so to ward off mental collapse they turn to their smart phones for comfort.

How to Lower American Living Standards to that of North Korea

Source: Robert Bryce, "How to Lower U.S. Living Standards," Wall Street Journal, September 21, 2015.

September 28, 2015

California governor Jerry Brown, along with other prominent democrats such as President Obama, Hillary Clinton and Bernie Sanders want to cut carbon-dioxide emissions by 80% by 2050 (80 by 50) to levels of that of developing countries such as North Korea.

Earlier this month the California Assembly rejected a bill that would have required the state to reduce emissions by 80%. In addition, all of the candidates seeking the Democratic nomination for president support this emissions reduction program. What would 80 by 50 mean for individuals? Residents of California are responsible for the emission of about 9.42 tons of carbon dioxide per capita per year, the program would cut those emissions to 1.88 tons by 2050. Achieving 80 by 50 on a national basis will be even more painful, as the national average is 16.15 tons per capita. Wind and solar energy cannot be the solution.

Their land-use requirements are enormous, they can't store large quantities of electricity and their transmission is intermittent. Nuclear energy is doing more to cut carbon-dioxide emissions than any other form of energy, but Democratic politicians and their supporters decry it. None of the plan's supporters has provided a cost estimate but it's likely that it would cost more than $5 trillion.

In short, the leading Democrat contenders for the White House, have endorsed an agenda that will have a massive cost. Yet not one of them has provided a credible plan for achieving such reductions without wrecking the economy. They do not even discuss a plan that is affordable and technically viable because that is a very unlikely scenario.

States Debts Huge : A Failing Economy & Politics

First, I believe the economy is not doing well as this author states, given the 93 million unemployed and under employed and food stamps out of control. Therefore the problems for states, beyond outdated accounting practices and a failing economy only compounds their problems to balance their budgets.

Of course, the over riding worst cause for financial failure in the states is the politics of 'take the money and run'. The politicians just don't have the will to do the right thing. There is nothing more important then getting reelected to stay on the state tit. After all, they are politicians for a reason, and it's not to take responsibility for living up to the oath they took when they entered office.

Financial State of the States

Source: Robert Rector, "Financial State of the States," Truth in Accounting, September 2015.

September 28, 2015

Despite an improvement in the economy, the amount of bills accumulated by the states has not significantly decreased. States still have almost $1.3 trillion of unfunded debt. Currently, 39 states have deficits, thus, they've accrued a taxpayer burden.

The taxpayer burden is the amount each taxpayer would have to pay the state's treasury in order for the state to be debt free. To correct these issues a new system called Full Accrual Calculations and Techniques (FACT) has been developed and would require states to recognize expenses when incurred regardless of when they are paid.

The $1.6 trillion in taxes paid by the top quintile represented approximately 30% of its pre-tax income. The five worst taxpayer burdens were: New Jersey, Connecticut, Illinois, Kentucky and Massachusetts. The best taxpayer surpluses were attained by Alaska, North Dakota, Wyoming, Utah and South Dakota.

The reasons for these taxpayer burdens is caused by states using outdated accounting policies to calculate budgets and financial reports and not being held to the same accounting standards as most businesses

Of course, the over riding worst cause for financial failure in the states is the politics of 'take the money and run'. The politicians just don't have the will to do the right thing. There is nothing more important then getting reelected to stay on the state tit. After all, they are politicians for a reason, and it's not to take responsibility for living up to the oath they took when they entered office.

Financial State of the States

Source: Robert Rector, "Financial State of the States," Truth in Accounting, September 2015.

September 28, 2015

Despite an improvement in the economy, the amount of bills accumulated by the states has not significantly decreased. States still have almost $1.3 trillion of unfunded debt. Currently, 39 states have deficits, thus, they've accrued a taxpayer burden.

The taxpayer burden is the amount each taxpayer would have to pay the state's treasury in order for the state to be debt free. To correct these issues a new system called Full Accrual Calculations and Techniques (FACT) has been developed and would require states to recognize expenses when incurred regardless of when they are paid.

The $1.6 trillion in taxes paid by the top quintile represented approximately 30% of its pre-tax income. The five worst taxpayer burdens were: New Jersey, Connecticut, Illinois, Kentucky and Massachusetts. The best taxpayer surpluses were attained by Alaska, North Dakota, Wyoming, Utah and South Dakota.

The reasons for these taxpayer burdens is caused by states using outdated accounting policies to calculate budgets and financial reports and not being held to the same accounting standards as most businesses

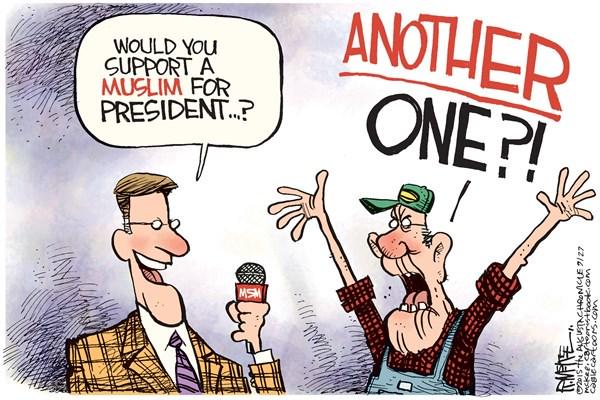

A Muslim for President : What? Another One?

Toothless and mindless dolts they are not.

Monday, September 28, 2015

It's a Clock - Stupid : Kerry is Skeptical

John is not sure what he sees is a clock - but Mr Obama said it was clock, so that good enough for me.

Markets Looking for Direction : The Future Looks Dim

What it's all about is leadership and trust - who do you trust to do the right thing. Is there anyone that you trust running for president that will lead our country back from destruction?

Everyone today is sacred for the future of the country and how the total lack of leadership will bring national problems to their individual doorstep. Misinformation and out right lies drives the narrative from our government.

Running Markets into Ruin

Source: James Rickards, "How Central Planning Ruins Markets," National Center for Policy Analysis, September 2015.

September 28, 2015

The impulse toward central planning often springs from the perceived need to solve a problem with a top-down solution. For Chinese Communists in 1949, it was local corruption and foreign imperialism. For the central planners at central banks today, the problem is deflation and low nominal growth.

However, no individual, committee or computer program would ever have all the information needed to construct an economic order, even if a model of such order could be devised. Manipulated data provide false signals:

"When a financial indicator becomes the object of policy, it ceases to function as an indicator."

Central planning is impossible: optimality emerges from economic complexity spontaneously rather than being imposed by central banks through policy.

Central bankers create asset bubbles: America is today witnessing its third stock bubble, and its second housing bubble, in the past 15 years. When these bubbles burst, the economy will confront a worse panic than occurred in 2008, and the bankers' cries for bailouts will not be far behind.

Main Street is the primary victim: savers are penalized, small business lending shrivels, banks take on greater risks, stocks boom and bust. Charles Kindleberger correctly identified the cause of the protracted nature of the Great Depression as regime uncertainty. This theory holds that even when market prices have declined sufficiently to attract investors back into the economy, investors may still refrain because unsteady public policy makes it impossible to calculate returns with any degree of accuracy.

The same malaise afflicts the U.S. economy today due to regime uncertainty caused by budget battles, health care regulation, tax policy and environmental regulation. The issue is not whether each policy choice is intrinsically good or bad. The core issue is that investors do not know which policy will be favored and therefore cannot calculate returns with sufficient clarity.

Everyone today is sacred for the future of the country and how the total lack of leadership will bring national problems to their individual doorstep. Misinformation and out right lies drives the narrative from our government.

Running Markets into Ruin

Source: James Rickards, "How Central Planning Ruins Markets," National Center for Policy Analysis, September 2015.

September 28, 2015

The impulse toward central planning often springs from the perceived need to solve a problem with a top-down solution. For Chinese Communists in 1949, it was local corruption and foreign imperialism. For the central planners at central banks today, the problem is deflation and low nominal growth.

However, no individual, committee or computer program would ever have all the information needed to construct an economic order, even if a model of such order could be devised. Manipulated data provide false signals:

"When a financial indicator becomes the object of policy, it ceases to function as an indicator."

Central planning is impossible: optimality emerges from economic complexity spontaneously rather than being imposed by central banks through policy.

Central bankers create asset bubbles: America is today witnessing its third stock bubble, and its second housing bubble, in the past 15 years. When these bubbles burst, the economy will confront a worse panic than occurred in 2008, and the bankers' cries for bailouts will not be far behind.

Main Street is the primary victim: savers are penalized, small business lending shrivels, banks take on greater risks, stocks boom and bust. Charles Kindleberger correctly identified the cause of the protracted nature of the Great Depression as regime uncertainty. This theory holds that even when market prices have declined sufficiently to attract investors back into the economy, investors may still refrain because unsteady public policy makes it impossible to calculate returns with any degree of accuracy.

The same malaise afflicts the U.S. economy today due to regime uncertainty caused by budget battles, health care regulation, tax policy and environmental regulation. The issue is not whether each policy choice is intrinsically good or bad. The core issue is that investors do not know which policy will be favored and therefore cannot calculate returns with sufficient clarity.

Atheists : Self Control Is Enough

A song lyric that typifies the atheists is ' I believe there is no god, but I pray there is no hell'.

Who or What Is Mr Obama? : Christian? Muslim? Hindu?

Why all the out rage over someone asking the question about Mr Obama's religious back ground? Why is the press and the progressive socialists pulling their hair out over this?

Why all the out rage over someone asking the question about Mr Obama's religious back ground? Why is the press and the progressive socialists pulling their hair out over this?More then 30% of the population believe he is a Muslim.

Doesn't it seem strange that even the mention of Mr Obama being a Muslim completely drives the liberal democrats into a rage?

The audacity to say something so heinous is unforgivable for the democrats and their friends in the press.

Porgressives Use The Pope As A Prop : Ideology Hard to Hide

And know as well that they will use and abuse anyone or anything that they believe can attack and destroy any opposition.

In this instance, it's the Pope and the Catholics are the pawns. The progressive socialists have not tired to hide their discomfort with Christians and their hatred of the Jews. Yet, here they are, smiles all around for the head of the largest Christian organization in the world.

As the saying goes, ' you can remove the spots from the leopard but the cat will always be a leopard'.

Muslim Student Testing Security : Clock Story Intentionally False

I wonder why this story was spiked for the most part even on FOX? That a Muslim student intentional brings a device to school that he knew was not a clock as he said it was, seems to be off limits to the press and their supports in our government. It was actually a dry run by him and his father the test the limits of tolerance for Muslims in our system to protect the country. It's not about racism or discrimination.

That this 'child' is a potential terrors that will eventually want to do more then just fool the people around him as well as the clueless, biased and dangerous media that will do everything in their power to protect, seems to be the norm today and that Muslims are untouchable no matter how disingenuous.

Truly we are headed in a direction that guarantees disaster will fall upon our country. Why is this not important to those is power? What ever happened to telling the truth? Doesn't anyone care any more about knowing and understanding what happens around us?

Why isn't there any outrage that we are being lied to by the media and our government officials?

The Clock Faker Goes International

September 27, 2015 by John Hinderaker in Islam, Race and racial bias

The story of Ahmed Mohamed is one of the most revealing of our time. Ahmed, a 14-year-old Texas student whose father keeps running for president of Sudan, took apart a clock and stuck the clock’s workings in a case with a lot of wires, dummied up to look like a suitcase bomb. (I assume everyone understands that such bombs use timers, i.e., clocks.) He claimed to have invented or built a clock, when in fact he had merely dismantled and disguised one. Why did he do this? He wanted school authorities to think that he had brought a bomb to school so he could expose their “racism.” Neil Munro sums it up:

Ahmed himself explains on a Turkish web site:

That this 'child' is a potential terrors that will eventually want to do more then just fool the people around him as well as the clueless, biased and dangerous media that will do everything in their power to protect, seems to be the norm today and that Muslims are untouchable no matter how disingenuous.

Truly we are headed in a direction that guarantees disaster will fall upon our country. Why is this not important to those is power? What ever happened to telling the truth? Doesn't anyone care any more about knowing and understanding what happens around us?

Why isn't there any outrage that we are being lied to by the media and our government officials?

The Clock Faker Goes International

September 27, 2015 by John Hinderaker in Islam, Race and racial bias

The story of Ahmed Mohamed is one of the most revealing of our time. Ahmed, a 14-year-old Texas student whose father keeps running for president of Sudan, took apart a clock and stuck the clock’s workings in a case with a lot of wires, dummied up to look like a suitcase bomb. (I assume everyone understands that such bombs use timers, i.e., clocks.) He claimed to have invented or built a clock, when in fact he had merely dismantled and disguised one. Why did he do this? He wanted school authorities to think that he had brought a bomb to school so he could expose their “racism.” Neil Munro sums it up:

The boy’s device was a commercial 120-volt alarm clock, first dismantled and then placed in a case where the screen could not be seen by any users. [Ed.: Great clock!] The boy also left the clock’s innards exposed, so when the power-cord was plugged in, the clock could electrocute anyone who reached inside the case to turn the alarm on or off. The device’s intended purpose was so obscure, in fact, that puzzled police and teachers thought it was a hoax-bomb.Which evidently was what Ahmed had in mind. His ploy worked like a charm: the story was big news nationwide, and Barack Obama invited the boy to the White House, while he was also feted by Google, MIT and others. Needless to say, Obama didn’t invite the boy who was suspended from elementary school for biting a pop tart into the shape of a gun to the White House. So this story isn’t about the silliness of zero tolerance school policies, it is about…what, exactly?

Ahmed himself explains on a Turkish web site:

Turkish Prime Minister Ahmet Davutoğlu, who is New York for the 70th United Nations General Assembly, has met with 14-year-old student Ahmed Mohamed, who was detained at school by the police in Texas when a teacher thought a clock he had made was a bomb.I take it that “racism and discrimination” means taking note of the fact that Muslims commit an awful lot of terrorist acts. Although, to be fair to the principal and teachers at Ahmed’s school, they would have reacted the same way regardless of who brought a fake suitcase bomb to school. The pop tart kid, after all, was no Muslim. Which is why Google and MIT took no interest in him.

Mohamed was among the invitees of a reception in New York on Sept. 25, which was also attended by Prime Minister Davutoğlu. …

Speaking to reporters before the reception, Mohamed said he was excited to meet the Turkish prime minister.

“Despite everything, we should always be creative, even when others turn you down,” said Mohamed.

“My dream is to raise consciousness against racism and discrimination,” he said, adding that he would like to visit Turkey in the future.

Mohamed, a Muslim teenager, became an overnight celebrity after a teacher confiscated his clock and alerted school officials when it started beeping in one of his classes.

Sunday, September 27, 2015

Defunding ACLU A Must : Ideology of Destruction

The ACLU is a biased organization that is controlled by progressive socialist liberal democrats or worse. The fact the founder of this organization was a communist tells a lot about the ideology of it's present members. Worst of all, this organization is taxpayer supported.

Like Planned Parent Hood, the ACLU is dedicated to the destruction of the living and the dead.

SANTA BARBARA BEACH................

The pictures were taken at the beach in Santa Barbara right next to the Pier. There is a veterans group that started putting a cross and candle for every death in Iraq and Afghanistan. The amazing thing is that they only do it on the weekends.

Like Planned Parent Hood, the ACLU is dedicated to the destruction of the living and the dead.

SANTA BARBARA BEACH................

The pictures were taken at the beach in Santa Barbara right next to the Pier. There is a veterans group that started putting a cross and candle for every death in Iraq and Afghanistan. The amazing thing is that they only do it on the weekends.

They put up this graveyard and take it down every weekend. Guys sleep in the sand next to it and keep watch over it at night so nobody messes with it. Every cross has the name, rank and D.O.B. and D.O.D. on it. Very moving, very powerful. So many young volunteers. So many 30 to 40 year olds as well. Amazing!

The ACLU (American Civil Liberties Union) has filed a suit to have all Military Cross-shaped headstones removed.

And they filed another suit to end prayer from the military completely. They're making great progress.

The Navy Chaplains can no longer mention the name of Jesus in prayer thanks to the ACLU.

Redistribution of Wealth : The Final Solution for Control

Progressive socialism is based on taking from the productive and giving to the unproductive. Members of the progressive liberal democrat party(Collective) are dedicated to the redistribution of wealth as means to an end, that is the ideology for a population that has it's main force in life is just survival. Freedom to chose is no longer an option.

The Redistributive State

Source: Robert Rector, "The Redistributive State: The Allocation of Government Benefits, Services, and Taxes in the United States," Heritage Foundation, September 15, 2015

September 25, 2015

The government functions as a redistributive mechanism: some households receive more than they contribute in taxes and some pay more than they receive. Direct benefit programs involve a transparent transfer of economic resources and it is easy to identify the beneficiaries; the largest of these programs are Social Security and Medicare, other programs include Unemployment Insurance and Workmen's Compensation.

Transfers also encompass means-tested benefits and are available only to low-income households, among these are Medicaid, the Earned Income Tax Credit, food stamps and Section 8 housing. Some of these services provide cash while others pay for services. Other services include public education, population-based services, pure public goods and interests and obligations.

The study reveals that: Measured on a per capita basis, the bottom quintile actually received 2.4 times more government benefits and services than the top quintile. The distribution of total taxes was highly unequal. The top quintile paid 16 times more in taxes than the bottom quintile. The $1.6 trillion in taxes paid by the top quintile represented approximately 30% of its pre-tax income. There was a transfer of roughly $1 trillion in economic resources from the top two quintiles to the bottom three.

The lowest three income quintiles of households received benefits that exceeded taxes paid, while the two highest ones paid taxes that exceeded benefits received.

The Redistributive State

Source: Robert Rector, "The Redistributive State: The Allocation of Government Benefits, Services, and Taxes in the United States," Heritage Foundation, September 15, 2015

September 25, 2015

The government functions as a redistributive mechanism: some households receive more than they contribute in taxes and some pay more than they receive. Direct benefit programs involve a transparent transfer of economic resources and it is easy to identify the beneficiaries; the largest of these programs are Social Security and Medicare, other programs include Unemployment Insurance and Workmen's Compensation.

Transfers also encompass means-tested benefits and are available only to low-income households, among these are Medicaid, the Earned Income Tax Credit, food stamps and Section 8 housing. Some of these services provide cash while others pay for services. Other services include public education, population-based services, pure public goods and interests and obligations.

The study reveals that: Measured on a per capita basis, the bottom quintile actually received 2.4 times more government benefits and services than the top quintile. The distribution of total taxes was highly unequal. The top quintile paid 16 times more in taxes than the bottom quintile. The $1.6 trillion in taxes paid by the top quintile represented approximately 30% of its pre-tax income. There was a transfer of roughly $1 trillion in economic resources from the top two quintiles to the bottom three.

The lowest three income quintiles of households received benefits that exceeded taxes paid, while the two highest ones paid taxes that exceeded benefits received.

Remember the first Dodd/Frank bill, the Community Reinvestment Act(CRA) that brought us the housing disaster? Yeah, it's the same two that now are responsible for more disaster to our economic system, and they both just happen to be progressive socialist liberal democrats. Who knew?

What good reasons to vote for more democrats and more disaster. Why is so hard for millions of our citizens to understand?

Dodd-Frank Harms Main Street

Source: Iain Murray, "How Dodd-Frank Harms Main Street," National Center for Policy Analysis, September 2015.

September 25, 2015

What good reasons to vote for more democrats and more disaster. Why is so hard for millions of our citizens to understand?

Dodd-Frank Harms Main Street

Source: Iain Murray, "How Dodd-Frank Harms Main Street," National Center for Policy Analysis, September 2015.

September 25, 2015

Wall Street Reform and Consumer Protection Act -- popularly known as Dodd-Frank named after its main sponsors -- were intended to protect Main Street and consumers from financial predation by Wall Street. Instead, the law has reduced access to credit for small businesses and has resulted in fewer choices for consumers, while doing little to punish the main culprits in the financial crisis.

Officials sold the Dodd-Frank Act to the American people as promoting financial soundness and stability by reining in Wall Street and the big banks. Instead, much of Dodd-Frank is a broad enabling act granting power to executive-agency bureaucrats to write specific regulations outside the checks-and-balances oversight governing the rest of the federal government.

In the meantime, the bankers of Wall Street can sleep easy knowing that they can raise capital more cheaply, and regulators know that a good, high-paying job awaits them in compliance departments there.

Officials sold the Dodd-Frank Act to the American people as promoting financial soundness and stability by reining in Wall Street and the big banks. Instead, much of Dodd-Frank is a broad enabling act granting power to executive-agency bureaucrats to write specific regulations outside the checks-and-balances oversight governing the rest of the federal government.

- Dodd-Frank raises the price of insurance. An April 2013 study by the consultancy Oliver Wyman found that the OLA would raise consumers' aggregate life insurance premiums $3 billion to $8 billion a year, with the bulk affecting retirees.

- Dodd-Frank reduces the number of banks. Two thousand community banks and credit unions have closed or merged since 2010, with community banks being hit hardest.

- Dodd-Frank raises user fees. The average minimum monthly holding requirement for no-fee banking tripled from $250 to $750. These fee increases made the banking system too expensive for about a million people, largely from the poorest sectors of society.

In the meantime, the bankers of Wall Street can sleep easy knowing that they can raise capital more cheaply, and regulators know that a good, high-paying job awaits them in compliance departments there.

Hollywood's Tolerance for You? : Maybe Not

Here's more good reasons to delete anything that come our of Hollywood as fact. These are actors and therefore work and live in a fantasy world. Why would we grant them any creditability?

Hollywood’s Idea of Tolerance: Mocking Kentucky Clerk Kim Davis at the Emmys

Katrina Trinko / @KatrinaTrinko

There’s nothing funnier than laughing at a woman trying to stay true to her beliefs.

That appears to be the understanding of Emmy host Andy Samberg, who, during his opening monologue, decided to single out Kim Davis, the Democrat Kentucky clerk who was jailed for her refusal to issue same-sex marriage licenses.

(Warning: The quote below may offend some readers.)

“Paula Deen is on this season of ‘Dancing With the Stars,’ but I’ve got to say, if I wanted to see an intolerant lady dance I would have gone to one of Kim Davis’ four weddings,” Samberg cracked.

It’s no secret that Hollywood is pro-same-sex marriage. But why pick on Davis?

Yes, she was married four times—before she converted to Christianity. (According to The Guardian, Davis married for the fourth time in 2009, while her legal counsel told U.S. News and World Report she converted to Christianity around four years ago.) As The Federalist’s witty headline, “Kentucky Clerk Didn’t Follow Christianity Before Converting to It,” expresses it, the media is missing the fact that Davis personally changed. Or, to adopt our president’s terms, evolved.

But it’s also baffling because no one should understand better than Hollywood the moral drive Davis has. After all, long before gay marriage was legal, the entertainment industry has worked to make gay characters and gay marriage a sympathetic cause.

In 2001, three years before any states had legal same-sex marriage, “Kissing Jessica Stein,” a movie about a lesbian romance, earned rave reviews from critics. Four years later, when same-sex marriage was only legal in Massachusetts, “Brokeback Mountain,” which chronicled the love affair of two men, won three Oscars and was nominated for Best Picture.

And let’s not forget “Will and Grace,” the TV show, which ran from 1998 to 2006, and focused on the friendship between a gay man and a straight woman. When Vice President Joe Biden did his famous interview on “Meet the Press” in 2012, announcing his support for gay marriage, he cited “Will and Grace.” “When things really began to change is when the social culture changes,” Biden said. “I think ‘Will and Grace’ probably did more to educate the American public than almost anybody’s ever done so far.”

“Will and Grace” star Debra Messing tweeted at the time:

Sure, no one’s expecting the Emmys to celebrate Davis. But does she deserve mockery Entertainment, at its best, can serve as a way to encourage people to follow their conscience, to dare defiance of societal norms that are wrong. In another world, if Davis had been a clerk jailed because she was defying the law and issuing gay marriage licenses, she could have been the heroine who inspired a biopic who was played by Meryl Streep.

This wasn’t the only time empathy was in short supply at the Emmys. Also in the opening monologue, Samberg opted to make fun of both a Republican and a Democrat. He mocked the Democrat as “always look[ing] like his flight is delayed … Guy’s a mess.”

The Republican? Well, Samberg mocked him as “seem[ing] racist.” Yup, that’s definitely picking on both sides equally. For a culture that claims to embrace tolerance, Hollywood sure doesn’t show much to conservatives.

Hollywood’s Idea of Tolerance: Mocking Kentucky Clerk Kim Davis at the Emmys

Katrina Trinko / @KatrinaTrinko

There’s nothing funnier than laughing at a woman trying to stay true to her beliefs.

That appears to be the understanding of Emmy host Andy Samberg, who, during his opening monologue, decided to single out Kim Davis, the Democrat Kentucky clerk who was jailed for her refusal to issue same-sex marriage licenses.

(Warning: The quote below may offend some readers.)

“Paula Deen is on this season of ‘Dancing With the Stars,’ but I’ve got to say, if I wanted to see an intolerant lady dance I would have gone to one of Kim Davis’ four weddings,” Samberg cracked.

“It’s so ironic,” he added, “that she came out of jail to ‘Eye of the Tiger’ when you consider how many dudes have boned each other to that song.”

(So much for an Emmys show that parents could comfortably watch with their children—which might be one reason why ratings were down 20 percent this year, according to Variety.)It’s no secret that Hollywood is pro-same-sex marriage. But why pick on Davis?

Yes, she was married four times—before she converted to Christianity. (According to The Guardian, Davis married for the fourth time in 2009, while her legal counsel told U.S. News and World Report she converted to Christianity around four years ago.) As The Federalist’s witty headline, “Kentucky Clerk Didn’t Follow Christianity Before Converting to It,” expresses it, the media is missing the fact that Davis personally changed. Or, to adopt our president’s terms, evolved.

But it’s also baffling because no one should understand better than Hollywood the moral drive Davis has. After all, long before gay marriage was legal, the entertainment industry has worked to make gay characters and gay marriage a sympathetic cause.

In 2001, three years before any states had legal same-sex marriage, “Kissing Jessica Stein,” a movie about a lesbian romance, earned rave reviews from critics. Four years later, when same-sex marriage was only legal in Massachusetts, “Brokeback Mountain,” which chronicled the love affair of two men, won three Oscars and was nominated for Best Picture.

And let’s not forget “Will and Grace,” the TV show, which ran from 1998 to 2006, and focused on the friendship between a gay man and a straight woman. When Vice President Joe Biden did his famous interview on “Meet the Press” in 2012, announcing his support for gay marriage, he cited “Will and Grace.” “When things really began to change is when the social culture changes,” Biden said. “I think ‘Will and Grace’ probably did more to educate the American public than almost anybody’s ever done so far.”

“Will and Grace” star Debra Messing tweeted at the time:

In other words, Hollywood’s dedication to what many clearly viewed as the moral cause of “marriage equality” helped bring about the change in American culture. Yet where is the empathy for Davis, who shares Hollywood’s passion for being true to one’s beliefs, but has a different belief than most stars on gay marriage?@dmckee1976 @pinknews I'm thrilled Biden has come out in support of gay marriage and am beyond proud of what he said @ W&G #PROUD

Sure, no one’s expecting the Emmys to celebrate Davis. But does she deserve mockery Entertainment, at its best, can serve as a way to encourage people to follow their conscience, to dare defiance of societal norms that are wrong. In another world, if Davis had been a clerk jailed because she was defying the law and issuing gay marriage licenses, she could have been the heroine who inspired a biopic who was played by Meryl Streep.

This wasn’t the only time empathy was in short supply at the Emmys. Also in the opening monologue, Samberg opted to make fun of both a Republican and a Democrat. He mocked the Democrat as “always look[ing] like his flight is delayed … Guy’s a mess.”

The Republican? Well, Samberg mocked him as “seem[ing] racist.” Yup, that’s definitely picking on both sides equally. For a culture that claims to embrace tolerance, Hollywood sure doesn’t show much to conservatives.

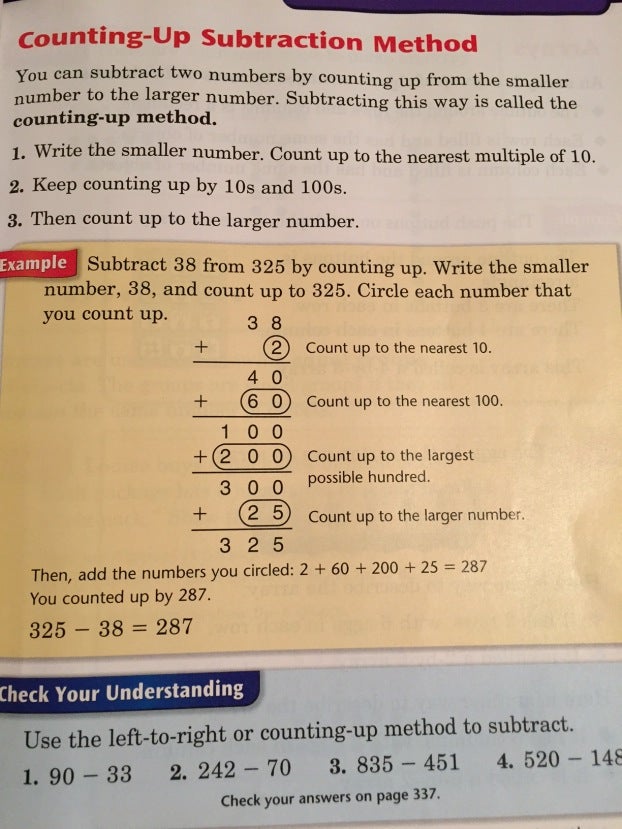

Common Core : A Work of The Mentally Unstable

Common Core is being debated in most school systems as to it's workability. Interesting how this comes across as the new norm to educate the next generation of students. One has to wonder who came up with this and whether they are mentally stable.

6 Steps to Subtract 2 Numbers: Common Core Homework in 1 Photo

Kelsey Lucas / @KelsRenLuc

For third-graders learning Common Core math in Georgia, there are four ways to subtract—and only four ways allowed. The picture above is just one of the methods for subtraction under Common Core straight from RedState editor in chief Erick Erickson’s third-grade daughter’s math book.

Missing from the four methods: borrowing and carrying numbers. You know, the old-fashioned-taught-the-same-way-for-decades-granny-method-not-approved-by-bureaucrats subtraction.

According to this third-grade textbook, students must take about six steps (at minimum, depending how you count) to subtract just two numbers. And if you don’t show your work, circle the right numbers and “count up” correctly, you haven’t proven that you’ve mastered the “why” of the problem.

In a previous post where I highlighted two “Homework Helper” videos a local news station broadcast because parents were struggling with their children’s Common Core homework, it’s clear memorization is out—explaining the “why” is in.

I’d love to see some more techniques for problems formerly referred to as “simple” math. Please leave your own pictures of Common Core homework in the comments and share this absurdity with your friends.

It Takes a Teacher 56 Seconds to Explain How to Add 9 Plus 6

6 Steps to Subtract 2 Numbers: Common Core Homework in 1 Photo

Kelsey Lucas / @KelsRenLuc

For third-graders learning Common Core math in Georgia, there are four ways to subtract—and only four ways allowed. The picture above is just one of the methods for subtraction under Common Core straight from RedState editor in chief Erick Erickson’s third-grade daughter’s math book.

Missing from the four methods: borrowing and carrying numbers. You know, the old-fashioned-taught-the-same-way-for-decades-granny-method-not-approved-by-bureaucrats subtraction.

According to this third-grade textbook, students must take about six steps (at minimum, depending how you count) to subtract just two numbers. And if you don’t show your work, circle the right numbers and “count up” correctly, you haven’t proven that you’ve mastered the “why” of the problem.

I’d love to see some more techniques for problems formerly referred to as “simple” math. Please leave your own pictures of Common Core homework in the comments and share this absurdity with your friends.

It Takes a Teacher 56 Seconds to Explain How to Add 9 Plus 6

The Media Spins The Pope's Visit? : Religion or Politics?

The visit by the Pope is confusing - trying to understand who this man is and what he represents as the leader of a religious order of more then a billion people, leaves little comfort for the rest of us as he prepares to depart America.

The visit by the Pope is confusing - trying to understand who this man is and what he represents as the leader of a religious order of more then a billion people, leaves little comfort for the rest of us as he prepares to depart America. Maybe it really is all about the spin from the progressive media and the democrats who have a vested interest in making sure the Pope is seen first as a politically astute liberal left individual, and then secondly a religious leader.

As million of well wishing people press in to just see the man and revel in his bigger then life status, maybe the Pope has actually risen above the media and the political despots that believe their words are gospel, and that there isn't room for two gods, the God of salvation and the god of government.

We as a nation must decide which is more reflective of our society and who will best carry us into the future.

Saturday, September 26, 2015

Is He Muslim or Not? : What Difference Does it Make

Is Obama a Muslim, don't know, but that he hates Jews and Christians is historic. He has a track record on this subject that isn't hard to follow.

But what's a little confusing is if he a Muslim, and probably an Arab given his upbringing, why is he so friendly to Iran? Why put the United States at risk from attack just to launch Iran to dominance in the Middle East? Iranians are Persians and Arabs hate Persians.

What are we to believe?

(KIPP) Knowledge Is Power, Works : Leadership in Education

Ya' gotta' love innovation and the free market of ideas. Even though many students that attend college have no business being there, as there talents belong elsewhere, the KIPP schools system is headed in the right direction, providing leadership to the students when they need it the most.

Raising College-Ready Kids

Source: Christina Tuttle et al., "Understanding the Effect of KIPP as it Scales," Mathematica Policy Research, September 17, 2015.

September 24, 2015

The Knowledge is Power Project (KIPP) is a national network of free, open-enrollment, college-preparatory public schools dedicated to preparing students in underserved communities for success in college and life. KIPP elementary schools have positive, statistically significant and educationally meaningful impacts on reading and mathematics skills, preparing students for success in the higher grades.

KIPP middle schools have the same impacts on student achievement in math, reading, science, and social studies. For students continuing to KIPP high schools from KIPP middle schools, impacts on achievement are not statistically significant. For this group of continuing KIPP students, KIPP high schools have positive impacts on a variety of college preparation activities and the likelihood of applying to college.

There are 183 KIPP schools nation-wide in 20 states. Approximately 70,000 students in inner-city and rural settings are enrolled at a KIPP school. 87% of students are from low-income families and more than 82% of KIPP alumni have gone on to college. In 2010, the KIPP Foundation was awarded a five-year, $50 million Investing in Innovation (i3) scale-up grant by the U.S. Department of Education. The foundation used the i3 grant to scale up its network with the aim of sustaining KIPP's positive impacts -- specifically by bolstering its leadership pipeline -- while doubling the number of students served from 27,000 to over 55,000 by 2014-2015.

Raising College-Ready Kids

Source: Christina Tuttle et al., "Understanding the Effect of KIPP as it Scales," Mathematica Policy Research, September 17, 2015.

September 24, 2015

The Knowledge is Power Project (KIPP) is a national network of free, open-enrollment, college-preparatory public schools dedicated to preparing students in underserved communities for success in college and life. KIPP elementary schools have positive, statistically significant and educationally meaningful impacts on reading and mathematics skills, preparing students for success in the higher grades.

KIPP middle schools have the same impacts on student achievement in math, reading, science, and social studies. For students continuing to KIPP high schools from KIPP middle schools, impacts on achievement are not statistically significant. For this group of continuing KIPP students, KIPP high schools have positive impacts on a variety of college preparation activities and the likelihood of applying to college.

There are 183 KIPP schools nation-wide in 20 states. Approximately 70,000 students in inner-city and rural settings are enrolled at a KIPP school. 87% of students are from low-income families and more than 82% of KIPP alumni have gone on to college. In 2010, the KIPP Foundation was awarded a five-year, $50 million Investing in Innovation (i3) scale-up grant by the U.S. Department of Education. The foundation used the i3 grant to scale up its network with the aim of sustaining KIPP's positive impacts -- specifically by bolstering its leadership pipeline -- while doubling the number of students served from 27,000 to over 55,000 by 2014-2015.

Census Bureau Report On Poverty Incomplete : Why?

The question that remains, what is the motivation on the part of the censes bureau to not include all of the necessary information when making a determination to what exactly constitutes some one in poverty?

Another question to ponder, why is telling the truth so difficult for so many in government?

Poverty in the Richest Nation

Source: Robert Rector, "Poverty and the Social Welfare State in the United States and Other Nations," Heritage Foundation, September 16, 2015.

September 24, 2015

Contrary to conventional wisdom, the United States is one of the biggest spenders per capita on social welfare benefits in the world. Despite having a poverty level comparable to other western nations, the U.S. still outspends nearly every other country on programs addressing poverty. This fact tends to be obscured mainly because U.S. social welfare spending contains a larger private-sector/non-governmental component.

Social welfare expenditures consist of spending on health care, education, retirement benefits and other government transfer payments. When governmental and non-governmental spending are combined, social welfare absorbs around one-third of U.S. gross domestic product. Setting aside the private sector, the United States still has a very large social welfare system. In fact, among affluent nations, the United States has the third highest level of per capita government social welfare spending.

The living standards of the American poor are much higher than are imagined. This is because the Census ignores the value of any social welfare benefits a family receives when calculating income. The government's own data show that the actual living conditions of the more than 45 million people who are deemed "poor" by the Census Bureau differ greatly from popular conceptions of poverty.

The key to improving self-sufficiency is to increase work and healthy marriages. Increased self-reliance will lead to an enhanced sense of self-achievement, a principal component of human well-being. Restoring healthy marriages will sharply reduce poverty, improve child outcomes and increase adult happiness.

Another question to ponder, why is telling the truth so difficult for so many in government?

Poverty in the Richest Nation

Source: Robert Rector, "Poverty and the Social Welfare State in the United States and Other Nations," Heritage Foundation, September 16, 2015.

September 24, 2015

Contrary to conventional wisdom, the United States is one of the biggest spenders per capita on social welfare benefits in the world. Despite having a poverty level comparable to other western nations, the U.S. still outspends nearly every other country on programs addressing poverty. This fact tends to be obscured mainly because U.S. social welfare spending contains a larger private-sector/non-governmental component.

Social welfare expenditures consist of spending on health care, education, retirement benefits and other government transfer payments. When governmental and non-governmental spending are combined, social welfare absorbs around one-third of U.S. gross domestic product. Setting aside the private sector, the United States still has a very large social welfare system. In fact, among affluent nations, the United States has the third highest level of per capita government social welfare spending.

The living standards of the American poor are much higher than are imagined. This is because the Census ignores the value of any social welfare benefits a family receives when calculating income. The government's own data show that the actual living conditions of the more than 45 million people who are deemed "poor" by the Census Bureau differ greatly from popular conceptions of poverty.

The key to improving self-sufficiency is to increase work and healthy marriages. Increased self-reliance will lead to an enhanced sense of self-achievement, a principal component of human well-being. Restoring healthy marriages will sharply reduce poverty, improve child outcomes and increase adult happiness.

Tax Reform Proposed : Lee-Rudio Plan A Start

This seems like a good state to reforming our out of control tax system. This isn't an end-all by any means, but at least it's something to look at and debate. What we have now isn't working and hasn't for decades.

Lee-Rubio Tax Plan

Source: Tyler Prochazka and Pamela Villarreal, "Would the Lee-Rubio Tax Plan Help Lower-Income Households?" National Center for Policy Analysis, September 23, 2015

September 24, 2015

Since the roll-out of the Lee-Rubio tax proposal in March 2015, the Center on Budget and Policy Priorities and the Tax Foundation have disagreed whether the plan would benefit people at lower income levels. The short answer is: It depends. The Lee-Rubio plan is short on details regarding several provisions that could make a significant difference, particularly for those between poverty and the middle class.

Overall, though, low-income taxpayers will be better off under Lee-Rubio if Congress continues existing tax credits that are not discussed in the proposal, such as the earned income tax credit (EITC) and the additional child tax credit. The Lee-Rubio plan eliminates the standard deduction. The proposal does not say whether dependent exemptions would be eliminated also.

Under current law, they are worth $4,000 per year per dependent. In lieu of the exemption, the plan allows for a $2,000 personal credit for single filers, $4,000 for married couples. The Lee-Rubio plan also creates a new $2,500 child tax credit, which would be in addition to the current child tax credit and the earned income tax credit.

For taxpayers with children approaching middle class incomes, the new child tax credit could help lower their effective tax rates. While the EITC and other means-tested benefits phase out as income rises, this credit would offset that loss. Since filers with lower-incomes could probably claim more of the new child tax credit as their incomes rose, this could moderate the current tax disincentive for additional work and saving.

In general, the Lee-Rubio plan appears to give lower- and middle-class taxpayers a break while simplifying the tax-filing system.

Lee-Rubio Tax Plan

Source: Tyler Prochazka and Pamela Villarreal, "Would the Lee-Rubio Tax Plan Help Lower-Income Households?" National Center for Policy Analysis, September 23, 2015

September 24, 2015

Since the roll-out of the Lee-Rubio tax proposal in March 2015, the Center on Budget and Policy Priorities and the Tax Foundation have disagreed whether the plan would benefit people at lower income levels. The short answer is: It depends. The Lee-Rubio plan is short on details regarding several provisions that could make a significant difference, particularly for those between poverty and the middle class.

Overall, though, low-income taxpayers will be better off under Lee-Rubio if Congress continues existing tax credits that are not discussed in the proposal, such as the earned income tax credit (EITC) and the additional child tax credit. The Lee-Rubio plan eliminates the standard deduction. The proposal does not say whether dependent exemptions would be eliminated also.

Under current law, they are worth $4,000 per year per dependent. In lieu of the exemption, the plan allows for a $2,000 personal credit for single filers, $4,000 for married couples. The Lee-Rubio plan also creates a new $2,500 child tax credit, which would be in addition to the current child tax credit and the earned income tax credit.

For taxpayers with children approaching middle class incomes, the new child tax credit could help lower their effective tax rates. While the EITC and other means-tested benefits phase out as income rises, this credit would offset that loss. Since filers with lower-incomes could probably claim more of the new child tax credit as their incomes rose, this could moderate the current tax disincentive for additional work and saving.

In general, the Lee-Rubio plan appears to give lower- and middle-class taxpayers a break while simplifying the tax-filing system.

EPA Moves Again On Ozone Levels : EPA Modeling Corrupted (Who Knew?)

I know this is old news, but wait, the question at hand is government using tainted or out right false and manipulated modeling to support it's claim that lower ozone levels will benefit thousands of citizens is something to report or new? This just a rerun from years ago.

This a good time to use one of Hillarie's best phrases, "we must have a willingness to suspend disbelief" regarding the validity of the governments presentation of the facts.

The EPA's Next Big Economic Chokehold

Source: Tony Cox, "The EPA's Next Big Economic Chokehold," Wall Street Journal, September 1, 2015.

September 9, 2015

This a good time to use one of Hillarie's best phrases, "we must have a willingness to suspend disbelief" regarding the validity of the governments presentation of the facts.

The EPA's Next Big Economic Chokehold

Source: Tony Cox, "The EPA's Next Big Economic Chokehold," Wall Street Journal, September 1, 2015.

September 9, 2015

Encouraged by advocacy and lobbying groups such as the Natural Resources Defense Council and the American Lung Association, it is predicted that this fall, President Obama will set new, lower standards for ground-level ozone production to 60 parts per billion. The Environmental Protection Agency (EPA) predicts that lower man-made ozone levels will increase quality of life by reducing asthma and other respiratory diseases.

- However, the National Institutes of Health does not attribute climate change or ozone levels to the cause of asthma.

- Although ozone levels have fallen nationally since 2000, cases of asthma have increased.

- The cost of the new regulation, as estimated by the National economic Research Associates, is the loss of millions of jobs and trillions of dollars over the next two decades.

EPA Sets New Standards for CO2 : Obama Asks Courts to Defer to EPA?

Who's afraid to the EPA, everyone should be terrified of this agency and it's friends in the White House.

This boggles the mind - the courts are asked defer to government agencies to interpret their own mandates regarding the intent of congressional law making? Little wonder the EPA is totally out of control and is easily the most powerful and corrupt agency in this government, even more so the congress itself, and that's going some.

The Obama administration is setting new standards for absolute corruption of our Constitution, it's interpretation and it's principles. Want to be scared even more, it appears the majority or the population are ready to live under the new rules and regulations from the EPA as they voted twice for Mr Obama to make it happen.

Still not scared enough yet, it appears Gruber is right after all.

Who's Afraid of the EPA?

Source: William Yeatman, "EPA's Clean Power Plan Overreach," Competitive Enterprise Institute, July 28, 2015.

September 8, 2015

On June 2, 2014, the Obama Administration unveiled its key climate change initiative, the Clean Power Plan, targeting CO2 emissions from U.S. electrical power plants. In its proposal, the Administration took the unusual step of claiming Chevrondeference -- preemptively asking federal courts to defer how the plan will be interpreted entirely to the U.S. Environmental Protection Agency (EPA).

Chevron deference, named for a seminal 1984 Supreme Court ruling, is an oft-used administration principle of law claiming that federal courts should defer to reasonable agency construction of the statutes they are charged with administering. Fundamentally, the principle is an extension of Congress' lawmaking powers whereby agencies are delegated authority by Congress to interpret congressional mandates.

The D.C. Court of Appeals, which has jurisdiction for judicial review of the Clean Power Plan, applies the doctrine of constitutional avoidance in instances where the agency's interpretation of its mandate would raise constitutional difficulties. The Supreme Court ruled in King v. Burwell, that the presumption should be against Chevron in instances when the agency's interpretation of its mandate would expand agency control over issues of "deep economic and political significance."

The EPA's Clean Power Plan contravenes every principle undergirding Chevron deference. For starters, the agency enjoys no delegation of congressional authority to remake the retail electricity market, nor does the rule enjoy any semblance of electoral accountability. Also, the agency lacks expertise in overseeing the nation's electric grid.

The EPA's track record does not suggest that it can be trusted to take a reasonably transcribed interpretation of any congressional mandate to regulate emissions from any sector of private life or industry. The agency's expansive interpretation of the Clean Air Act, for instance, should give federal judges pause when considering whether or not to grant Chevron deference to a repeat offender.

This boggles the mind - the courts are asked defer to government agencies to interpret their own mandates regarding the intent of congressional law making? Little wonder the EPA is totally out of control and is easily the most powerful and corrupt agency in this government, even more so the congress itself, and that's going some.

The Obama administration is setting new standards for absolute corruption of our Constitution, it's interpretation and it's principles. Want to be scared even more, it appears the majority or the population are ready to live under the new rules and regulations from the EPA as they voted twice for Mr Obama to make it happen.

Still not scared enough yet, it appears Gruber is right after all.

Who's Afraid of the EPA?

Source: William Yeatman, "EPA's Clean Power Plan Overreach," Competitive Enterprise Institute, July 28, 2015.

September 8, 2015

On June 2, 2014, the Obama Administration unveiled its key climate change initiative, the Clean Power Plan, targeting CO2 emissions from U.S. electrical power plants. In its proposal, the Administration took the unusual step of claiming Chevrondeference -- preemptively asking federal courts to defer how the plan will be interpreted entirely to the U.S. Environmental Protection Agency (EPA).

Chevron deference, named for a seminal 1984 Supreme Court ruling, is an oft-used administration principle of law claiming that federal courts should defer to reasonable agency construction of the statutes they are charged with administering. Fundamentally, the principle is an extension of Congress' lawmaking powers whereby agencies are delegated authority by Congress to interpret congressional mandates.

The D.C. Court of Appeals, which has jurisdiction for judicial review of the Clean Power Plan, applies the doctrine of constitutional avoidance in instances where the agency's interpretation of its mandate would raise constitutional difficulties. The Supreme Court ruled in King v. Burwell, that the presumption should be against Chevron in instances when the agency's interpretation of its mandate would expand agency control over issues of "deep economic and political significance."

The EPA's Clean Power Plan contravenes every principle undergirding Chevron deference. For starters, the agency enjoys no delegation of congressional authority to remake the retail electricity market, nor does the rule enjoy any semblance of electoral accountability. Also, the agency lacks expertise in overseeing the nation's electric grid.

The EPA's track record does not suggest that it can be trusted to take a reasonably transcribed interpretation of any congressional mandate to regulate emissions from any sector of private life or industry. The agency's expansive interpretation of the Clean Air Act, for instance, should give federal judges pause when considering whether or not to grant Chevron deference to a repeat offender.

Friday, September 25, 2015

Bill Clinton's Personal Server : Not Just Hillarys

Consumption Tax Proposed : Breathing Is Not Free

What next? How about an air tax - everyone needs air, right, so why not estimate how much air is consumed on an avenge day and then access a tax. For those that exercise, bike, run or play sports, they can have a special category for increased consumption to stay healthy giving them a special rate.

Let's be honest here, having clean air to breath has cost billions and as a result everyone should have to pay something as they enjoy breathing each day. That's fair, right?

The Chicago Cloud Tax

Source: Jason Snead, "Chicago Adds Ridiculous 9% Tax on Netflix and Other Streaming Services," The Daily Signal, September 18, 2015.

September 23, 2015

On September 1, Chicago's "Cloud Tax" went into effect, levying a 9% amusement tax on internet streaming services such as Netflix, Spotify and Amazon Prime Video. These services are revolutionizing the way we access media and the Windy City wants in on the action. But a lawsuit filed on September 9 shows that not everyone is keen on this expansion of the city's taxing power.

The first of its kind, the lawsuit will impact similar taxing schemes being considered by local municipalities across the country searching for new streams of revenue to plug widening gaps in their budgets. The lawsuit challenges whether Chicago's comptroller, Dan Widawsky, was within his rights to expand the city's "amusement tax" to include streaming services for media. Chicago expects to bring in $12 million under the new law.